Church finance is about handling the church’s money, dealing with challenges like budgeting, fundraising, and finding new ways to bring in income. Good church financial management follows biblical principles and might need help from financial experts to keep things on track.

As a pastor or church leader, church finance can be a challenging task.

In this article, we will explore various strategies for managing church finances, including budgeting, fundraising, and cost-effective marketing strategies.

Managing the finances of a church is not an easy task. Churches rely on donations from their congregation to operate and carry out their mission.

However, it can be difficult to balance the needs of the church with the financial constraints of the congregation.

Churches face unique financial challenges that require careful planning and management.

In this article, we will explore various strategies for managing church finances, including budgeting, fundraising, and cost-effective marketing strategies.

Let’s dive in.

What is Church Financial Management?

Church financial management is the practice of managing and stewarding the financial resources of a church in a responsible and effective manner. It involves creating and implementing financial policies and procedures that are grounded in biblical principles, and that ensure that the church’s resources are used to support its mission and ministries.

Church financial management includes a range of tasks and responsibilities, including:

- Budgeting: Creating and managing a budget is an essential component of church financial management. A budget outlines the church’s expected revenues and expenses, and provides a framework for managing the church’s finances effectively.

- Financial Reporting: Financial reporting involves creating regular reports that provide an overview of the church’s financial position and performance. Financial reports should be transparent and accurate, and should be shared with church leaders and members on a regular basis.

- Internal Controls: Internal controls are policies and procedures that help prevent fraud, embezzlement, and other financial abuses. Effective internal controls include segregation of duties, regular audits, and other measures to safeguard the church’s resources.

- Fundraising: Fundraising is an important aspect of church financial management, as it helps generate revenue to support the church’s ministries and programs. Fundraising efforts should be grounded in biblical principles, and should be conducted in a transparent and responsible manner.

- Investment Management: Churches may also have investments that need to be managed effectively. Investment management involves creating investment policies and guidelines, and monitoring investments to ensure that they align with the church’s values and financial goals.

Overall, church financial management is essential to ensuring the financial stability and sustainability of a church.

By developing and implementing effective financial policies and procedures, churches can manage their resources in a responsible and effective manner, and ensure that their finances are aligned with their mission and values.

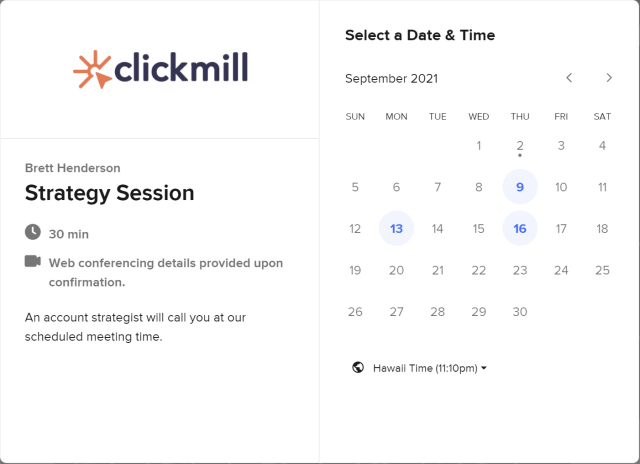

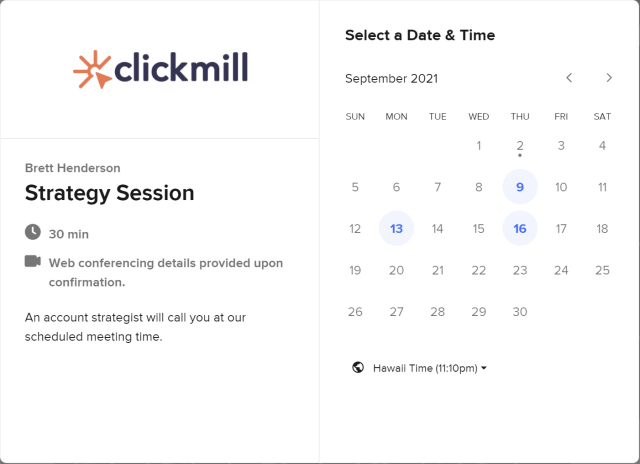

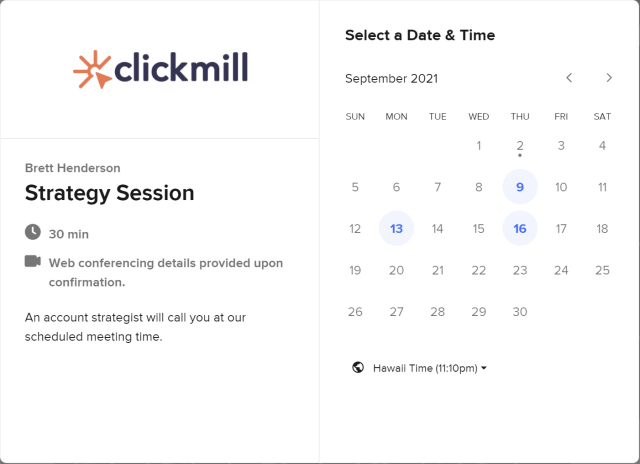

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

Common Problems In Church Finance

Before we dive into strategies for managing church finances, it’s important to understand the unique financial challenges that churches face.

Despite their best efforts, ministry leaders can still face financial challenges and difficulties.

Here are some of the most common problems in church finances:

- Declining Giving: One of the biggest challenges churches face is declining giving. When economic times are tough or members face financial difficulties, tithes and offerings may decrease. This can make it difficult for churches to meet their financial obligations and support their ministries and programs.

- Mismanagement of Funds: Another common problem is the mismanagement of funds. This can include overspending, embezzlement, or lack of financial transparency. When church leaders do not manage their finances responsibly, it can damage the church’s reputation and hinder its ability to carry out its mission.

- Inadequate Budgeting: Churches may also face financial challenges when they do not budget properly. When expenses are not properly accounted for, churches may run into financial shortfalls that can impact their operations and programs.

- Debt: Churches may also face financial challenges when they take on too much debt. When debt payments consume a large portion of the budget, it can limit the church’s financial flexibility and constrain its ability to carry out its mission.

- Inadequate Reserves: Churches may also face financial challenges when they do not have adequate reserves or emergency funds. When unexpected expenses arise or revenues decrease, churches without adequate reserves may struggle to meet their financial obligations.

- Lack of Financial Literacy: Another common problem is the lack of financial literacy among church leaders and members. When people do not understand financial principles or practices, it can lead to financial mismanagement or poor decision-making.

- Church Recessions: Churches may face financial challenges due to changes in economic conditions, such as recessions or economic downturns. During these times, tithes and offerings may decrease, making it difficult for churches to meet their financial obligations. Church financial management involves developing strategies to manage these challenges, such as reducing expenses, increasing fundraising efforts, or creating new income streams. You read see our whole post on this titled, Church Economics: The Church Recession Survival Guide.

In conclusion, while churches can face financial challenges, by practicing biblical finance principles and developing sound financial practices, churches can overcome these problems and ensure financial stability and sustainability.

By maintaining transparency, accountability, and responsible management of their resources, churches can support their mission and ministries and serve their communities effectively.

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

Church Finance: Budgeting for Your Church

Budgeting is a crucial aspect of managing church finances. A well-planned budget can help your church make informed decisions about how to allocate its resources.

Zero-based budgeting is an approach that can be particularly helpful for churches.

Zero-based budgeting starts with a “zero” balance and requires that every dollar is allocated to something.

There can be no more dollars allocated than dollars that exist, and there can be none left over.

This approach forces you to justify every expense and ensures that you are allocating your resources effectively.

To create a zero-based budget, start by listing all of your expenses and categorizing them by type, such as salaries, facilities, and programs.

Then, assign a dollar amount to each category based on the needs of the church and the available resources. Be sure to prioritize your expenses based on the most critical needs of the church.

Once you have assigned dollar amounts to all of your expenses, compare your total expenses to your total income to ensure that they are in balance.

If your expenses exceed your income, you may need to make adjustments to your budget, such as reducing expenses or increasing fundraising efforts.

A zero balance budget should indicate that there is $0 left at the end of the budget. All dollars must be allocated to something.

This approach can help your church be more intentional and strategic in how it allocates its resources.

By starting with a “zero” balance and carefully considering each expense, you can ensure that your resources are being used effectively and that your church is able to carry out its mission and ministries.

Fundraising for Your Church Finances

Fundraising is another important aspect of managing church finances. Fundraising can help supplement donations from your congregation and provide additional resources for your church.

There are many different ways to fundraise for your church, including hosting events, selling merchandise, and soliciting donations from local businesses.

When planning a fundraiser, it’s important to set clear goals and objectives and to communicate these goals to your congregation.

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

Church Finance: Additional Income Streams

It can be important for church leaders to consider creating additional streams of income to ensure financial stability and sustainability, especially during difficult economic times when tithes and giving may decline.

By diversifying their sources of income, churches can ensure that they are not solely dependent on donations from their congregation.

One potential source of additional income for churches is real estate.

Many churches own property that can be used to generate rental income or sold to generate a lump sum of money.

Another potential source of income is discipleship schools or private schools, which can provide tuition revenue and support the church’s mission of education and outreach.

Another potential source of income is coffee shops or event venues.

Many churches have underutilized space that can be converted into a coffee shop or event venue that can be rented out for additional income.

This not only provides an additional source of income for the church, but it also provides a community gathering space that can help support the church’s mission and outreach efforts.

Thrift stores are another potential source of income for churches. Many churches operate thrift stores that sell donated goods to generate income for the church.

These thrift stores not only provide an additional source of income for the church, but they also provide a valuable service to the community by providing affordable goods and supporting local charities.

Overall, having multiple streams of income can help churches weather difficult economic times and ensure financial stability and sustainability.

By exploring alternative sources of income such as real estate, discipleship schools, private schools, coffee shops, event venues, and thrift stores, churches can diversify their income sources and better support their mission and outreach efforts.

Cost-Effective Marketing Strategies

Marketing can be a crucial tool for growing your church and reaching new members of your community. However, traditional marketing methods can be expensive and may not be feasible for churches with limited budgets.

Fortunately, there are many cost-effective marketing strategies that churches can use to reach new members of their community. These include social media marketing, email marketing, and search engine optimization.

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

Church Finance & Budget Allocation

Financial planning is an important aspect of managing church finance. This involves creating a long-term plan for your church’s finances and setting clear goals and objectives for the future.

Financial planning can help your church make informed decisions about how to allocate its resources and ensure that it has the resources it needs to carry out its mission.

Here is a general guideline of how ministry resources are allocated in a typical healthy ministry:

Staff Salaries and Benefits: 40-50%

-Pastors and ministry staff salaries and benefits

-Office staff salaries and benefits

-Payroll taxes and benefits expenses

-Professional development expenses

Facilities and Maintenance: 15-20%

-Building mortgage or rent

-Utilities (electricity, water, gas, internet)

-Repairs and maintenance expenses

-Property insurance expenses

-Property taxes

Ministry Expenses: 15-20%

-Children and youth programs expenses

-Worship and music programs expenses

-Adult education programs expenses

-Small groups and discipleship programs expenses

-Special events and programs expenses

Missions and Outreach: 10-15%

-Local and global missions expenses

-Community outreach expenses

-Evangelism and outreach programs expenses

-Compassion and justice initiatives expenses

Administration: 5-10%

-Office supplies and equipment expenses

-Software and technology expenses

-Accounting and legal services expenses

-Insurance expenses (liability, worker’s compensation)

-Other administrative expenses

Reserves or Emergency Fund: 5%

-Emergency Fund

-Strategic Resource Allocation

-Church Investments (Real Estate, Coffee Shops)

Other: 0-5%

-Miscellaneous expenses not included in other categories

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

Biblical Principles of Church Finance

As someone managing church finance, it’s important to prioritize biblical principles that can guide your financial planning and decision-making. Here are ten practical biblical principles to keep in mind:

- Stewardship: Recognize that everything you have belongs to God and that you are responsible for managing your church’s resources in a way that honors Him (Psalm 24:1; 1 Corinthians 4:2).

- Giving: Prioritize giving back to God from the resources that He has given your church. Prioritize tithing and giving in your budget and financial planning (Malachi 3:10; 2 Corinthians 9:7).

- Generosity: Encourage your church to give freely and cheerfully, without expecting anything in return. Prioritize generosity in your financial planning and decision-making (2 Corinthians 9:6-7; Proverbs 11:25).

- Contentment: Be satisfied with what your church has and avoid excessive materialism. Avoid overspending or excessive debt (Hebrews 13:5; Ecclesiastes 5:10).

- Simplicity: Prioritize simple living and avoid unnecessary expenses. Avoid excessive spending on non-essential items (Matthew 6:19-21; Luke 12:15).

- Transparency: Maintain honesty and openness in your financial management. Maintain transparency in your financial reporting and decision-making (Proverbs 11:3; 1 Chronicles 29:17).

- Accountability: Hold yourself and others responsible for your financial decisions and actions. Maintain accountability in your financial management and decision-making (Luke 16:10-12; Proverbs 27:23-24).

- Prudence: Prioritize wise financial planning and decision-making. Avoid excessive risk-taking (Proverbs 21:5; Proverbs 22:3).

- Integrity: Maintain a high standard of ethical behavior in all financial matters. Prioritize ethical behavior in your financial management and decision-making (Proverbs 13:11; Proverbs 28:6).

- Faithfulness: Prioritize faithful stewardship and responsible financial management. Recognize that your church’s resources are a gift from God and that you are responsible for managing them wisely (1 Corinthians 4:1-2; Matthew 25:14-30).

By prioritizing these practical biblical principles in your financial planning and decision-making, you can ensure that your church’s resources are being used effectively to support its mission and ministries.

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

The Consultants Role In Church Finance

The role of a consultant in church finance can be crucial in helping churches effectively manage their resources and achieve their financial goals. A consultant can bring valuable expertise and experience to the table, helping churches navigate complex financial challenges and identify areas for improvement.

Some of the key areas where a church finance consultant can provide support and guidance include:

- Budgeting and financial planning: A consultant can help churches develop effective budgets and financial plans that align with their mission and priorities. They can provide guidance on how to allocate resources and prioritize spending to maximize impact.

- Cash flow management: Managing cash flow effectively is critical for churches, particularly during periods of economic uncertainty. A consultant can help churches monitor cash flow and develop strategies for managing cash effectively.

- Fundraising and development: A consultant can provide guidance on how to develop effective fundraising and development strategies that align with the mission and values of the church. They can help churches identify potential funding sources and develop campaigns to raise awareness and support.

- Financial reporting and compliance: Maintaining accurate financial records and complying with regulatory requirements is critical for churches. A consultant can help churches develop effective financial reporting processes and ensure compliance with relevant regulations.

- Risk management: Managing financial risk is an important aspect of effective financial management. A consultant can help churches identify potential risks and develop strategies for managing and mitigating them.

Overall, the role of a church financial consultant is to provide expert guidance and support to churches as they manage their financial resources. By working with a consultant, churches can develop effective financial strategies that support their mission and ministries, while also ensuring financial stability and sustainability over the long term.

Church Finance FAQs

Effective church financial management involves creating and adhering to a budget, ensuring transparent financial reporting, implementing strong internal controls to prevent financial abuses, engaging in responsible fundraising, and managing any investments in line with the church’s values and goals.

Churches often face challenges such as declining giving, mismanagement of funds, inadequate budgeting, excessive debt, insufficient reserves or emergency funds, lack of financial literacy among leaders and members, and economic downturns affecting tithes and offerings.

Budgeting is crucial in church finance as it provides a structured plan for expected revenues and expenses, helping churches allocate resources effectively, prioritize critical needs, and maintain financial stability.

Churches can explore additional income streams through avenues like renting out church property, establishing discipleship or private schools, operating coffee shops or event venues, and running thrift stores, thereby diversifying income and enhancing financial stability.

Cost-effective marketing strategies for churches include leveraging social media marketing, email marketing, and search engine optimization to reach and engage with the community without incurring significant expenses.

That about brings us to the end of this post on church financial management.

What financial principles or practices have you found to be most effective in managing church finances? How have you seen wise financial stewardship impact the mission and ministries of your church?

Let us know in the comments below!

Responses

Very educative

Wow! This article is so impactful. I am so glad I read it. Thank you very much.

If you love the quality of the article, you might also love our newly launched Christian training course platform, you can check it out at our home page!