Churches have long been recognized not only as pillars of spiritual growth but also as vital contributors to community development and at the very core of their operations and expansion lies the astute management of church money, a facet of church life that is as crucial as it is complex.

The way a church manages its finances is not just about keeping the lights on; it’s about fueling its mission to serve, uplift, and transform lives.

The strategies employed in managing church money directly influence the sustainability and effectiveness of their ministries, determining their ability to reach out, connect, and make a lasting difference in the community.

As you delve deeper into this article, you’ll discover strategies of financial stewardship within the church context.

We’ll explore how churches today can navigate the challenges of financial management, aligning their monetary decisions with their vision and community-oriented mission.

Whether you’re a church leader, a financial steward, or simply someone interested in the inner workings of church finance, this article is designed to offer valuable insights.

We’ll unravel the complexities of church money management, shed light on innovative strategies being adopted, and reveal how churches can not merely survive but thrive financially while staying true to their core mission.

This is more than just an exploration of numbers and budgets; it’s a window into how churches are creatively and responsibly turning financial challenges into opportunities for growth and impact.

The Bedrock of Church Finances: Tithes & Offerings

The Biblical Basis

The practice of tithing, deeply ingrained in the fabric of church tradition, is a testament to the church’s commitment to biblical principles.

Founded in the Old Testament as a support system for the Levitical priesthood (Numbers 18:21), tithing represented a tenth of an individual’s income, symbolizing not just financial support but also devotion, obedience and trust toward God.

“A tithe of everything from the land, whether grain from the soil or fruit from the trees, belongs to the Lord; it is holy to the Lord.” Leviticus 27:30

This practice was not merely transactional; it was a covenantal act, displaying the relationship of trust and honor between believers and God.

In the New Testament, this concept of giving evolves, as highlighted in 2 Corinthians 9:7.

“Each of you should give what you have decided in your heart to give, not reluctantly or under compulsion, for God loves a cheerful giver.”

Apostle Paul’s teachings pivot from a focus on the amount to the attitude behind the giving.

He emphasizes that each person should give what they have decided in their heart, not reluctantly or under compulsion, for God loves a cheerful giver.

This verse underscores the transition from a Old Covenant view of tithing to a heartfelt expression of generosity, reflective of one’s relationship and devotion unto God.

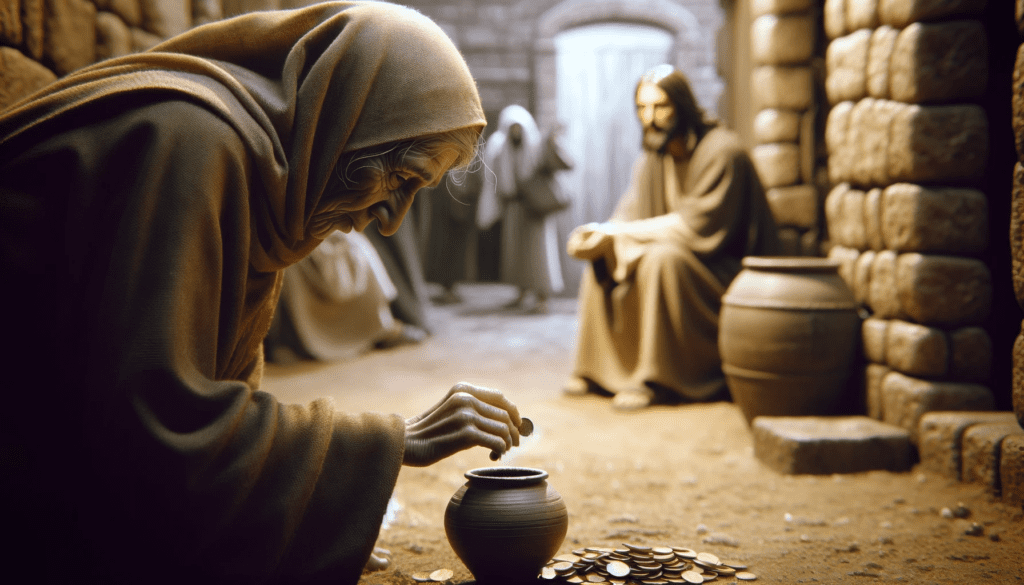

Jesus also highlights this notion with the story of the widow found in Mark 12:41-44.

The small offering of the widow, given out of her poverty, held more value than the larger contributions of the wealthy, as it was all she had to live on.

“Jesus sat down opposite the place where the offerings were put and watched the crowd putting their money into the temple treasury. Many rich people threw in large amounts. But a poor widow came and put in two very small copper coins, worth only a few cents.

Calling his disciples to him, Jesus said, “Truly I tell you, this poor widow has put more into the treasury than all the others. They all gave out of their wealth; but she, out of her poverty, put in everything—all she had to live on.”

This story speaks to the heart of giving in the church – it’s not the amount that counts, but the sincerity and sacrifice behind it.

In modern church practices, tithes and offerings continue to be the cornerstone of church finances.

This consistent flow of church money underpins the daily operations of the church, funding everything from staff salaries to ministry activities, and maintaining the church’s infrastructure.

The advent of the digital era has further revolutionized the process of giving.

Online giving platforms have emerged as powerful tools in managing church money, simplifying the process for donors and expanding the church’s reach.

This technological leap has not only enhanced convenience but has also potentially increased contributions, tapping into a broader demographic and appealing to a tech-savvy generation.

As churches continue to navigate the complexities of managing church money, integrating these biblical principles with modern financial strategies becomes crucial.

By doing so, churches not only honor their spiritual heritage but also ensure the effective stewardship of their resources, thereby fulfilling their mission and fostering community development.

#1 Church Money Strategy: Diversifying Income

In the evolving landscape of church finance, diversifying income streams has become a crucial strategy for ensuring financial stability and enhancing service to the community.

This shift goes beyond the traditional reliance on tithes and offerings, exploring new avenues to generate church money in alignment with their spiritual and community missions.

One innovative approach taken by churches is the strategic use of their real estate assets.

Many churches own properties that are ideal for hosting various community events that align with the ministries vision.

This method of generating church money involves renting out church facilities for events such as weddings, conferences, or community gatherings.

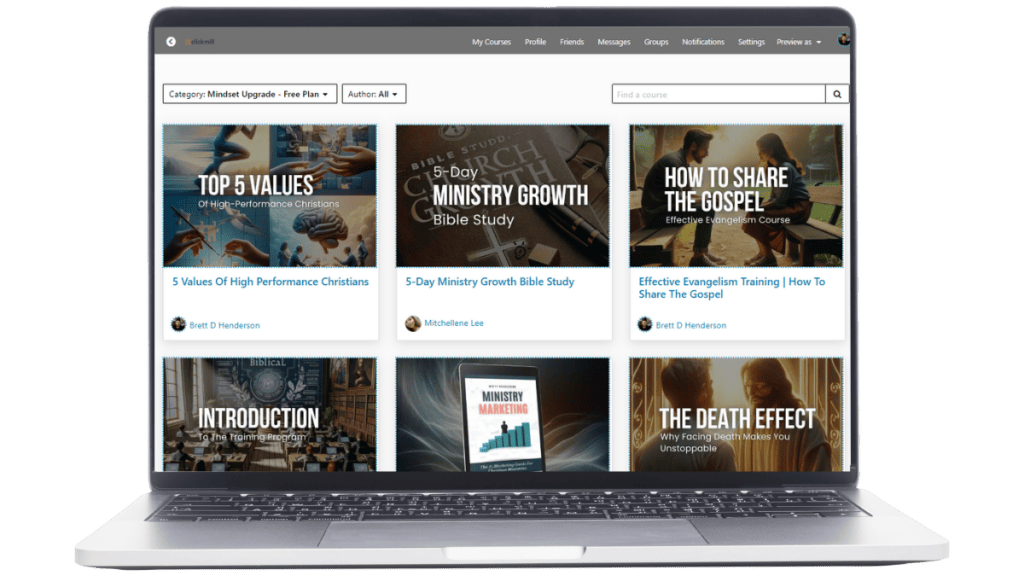

get 4 FREE Online Church Growth courses + 2 Ebooks, & More!

Access 4 Courses, 2 eBooks, Live Group Chat, Live Online Classes & More! Get The Growth God Has For Your Ministry – Get Your Free Account Today!

This approach is not just a financial strategy but also a means of community engagement.

By opening their doors for events, churches foster a sense of belonging and interaction with the broader community.

This increased visibility often leads to new memberships and more attendance, thus enriching the church community both spiritually and financially.

From a biblical perspective, this strategy resonates with the concept of stewardship, as described in Parable of the Talents (Matthew 25:14-30).

Here, the servants who wisely invested and multiplied their master’s money were commended.

Similarly, churches are utilizing their assets resourcefully, contributing not only to their financial growth but also to the welfare of the broader community.

#2 Church Money Strategy: Creating Church-Owned Businesses

Another emerging trend in church money management is venturing into entrepreneurial activities.

Churches are increasingly establishing bookstores, opening coffee shops, and even starting childcare centers within their premises.

These ventures align with the church’s ministry goals, meet the needs within the community and often serve as effective tools for community outreach.

By engaging in these businesses, churches are not only creating new sources of income but also building platforms for interaction and fellowship among church members and the local community.

This approach demonstrates a practical application of faith, as the church extends its role to both meeting spiritual and tangible community needs, reflecting the biblical call to serve others.

If you want to explore more avenues as sources of income for your church, take a look at our post Ultimate Church Merch Guide.

#3 Church Money Strategy: Utilizing Grants and Sponsorships

Furthermore, churches are actively seeking grants and sponsorships to support specific projects or mission-oriented activities.

This involves acquiring external funding from foundations, government programs, or private donors.

It’s imperative for churches to align with organizations and donors that share their values and mission to maintain their vision and focus.

The pursuit of grants and sponsorships represents a proactive approach to church money management.

This strategy not only provides necessary financial support but also opens doors for partnerships that can amplify the church’s impact in its community and beyond.

In today’s ever-evolving world, the financial sustainability and community impact of churches are increasingly dependent on both traditional and innovative approaches to managing church money.

This multifaceted approach to financial management is crucial, incorporating strategies such as effective budgeting, strategic investments, and proactive community engagement.

#4 Church Money Strategy: Maintaining Financial Sustainability

Navigating the financial landscape of church operations requires both prudence and foresight.

A key component of this journey is the strategic management of church funds, encompassing budgeting, expense management, and investment strategies.

These elements are essential for ensuring the church’s financial stability and capacity to fulfill its mission.

In this section, we delve into the specifics of budgeting and investment strategies, beginning with the innovative approach of Zero-Based Budgeting, a method that redefines traditional financial planning for churches.

Zero-Based Budgeting

Adopting zero-based budgeting is a forward-thinking strategy in church money management.

This method, which requires justification for every expense in each new budgeting period, starts from a zero base.

This approach aligns church funds with the church’s mission and goals, ensuring that every dollar is spent purposefully.

Zero-based budgeting is not just about cost control; it’s a strategic tool that aligns financial decisions with the church’s vision, echoing the biblical principle of good stewardship (Luke 14:28-30).

By meticulously reviewing every expense, churches can make informed decisions about resource allocation, optimizing the use of church money for maximum ministry impact.

Prudent Spending

The importance of regular financial reviews and cost-cutting measures cannot be overstated in maintaining a balanced budget.

Churches must vigilantly monitor their spending patterns, identifying areas where costs can be reduced without diminishing the quality of ministry services.

It involves strategic decision-making in resource allocation, ensuring that church money is not just spent, but invested in ways that amplify the church’s impact and support its long-term financial health.

Investment Strategies

In the current economic climate, churches are increasingly looking to investment strategies as a means of generating additional income.

Investing church money in diverse portfolios, including stocks, bonds, and real estate, can create alternative revenue streams, complementing traditional sources like tithes and offerings.

These investments, managed with discernment and prudence, can provide a financial buffer, enabling churches to support their ministries more robustly and expand their outreach efforts.

get 4 FREE Online Church Growth courses + 2 Ebooks, & More!

Access 4 Courses, 2 eBooks, Live Group Chat, Live Online Classes & More! Get The Growth God Has For Your Ministry – Get Your Free Account Today!

Building Reserves

Establishing emergency funds is another vital component of church money management.

Creating reserves for unexpected expenses is critical for the long-term stability and resilience of any church.

This proactive approach to financial planning is akin to the biblical principle of saving for the future.

It ensures that churches are well-prepared for unforeseen financial challenges, providing a safety net that preserves the church’s ability to serve its community effectively.

If you are in ministry and want more information on how to get through difficult financial times, check out our post Church Economics: The Church Recession Survival Guide.

#5 Church Money Strategy: Commitment to Meeting Needs

Engaging in service-oriented projects that address the needs of the community is not only a spiritual mandate but also a strategic approach to church money management.

By being actively involved in community service, churches can attract new members and open avenues for voluntary donations.

These projects often lead to increased church money contributions as the community sees the tangible impact of the church’s work as well as sponsorship opportunities or increased grant donations.

Having strong community ties are fundamental in the context of church finances.

When churches forge robust relationships within their community, they often find increased financial support and collaboration opportunities.

These relationships can lead to partnerships that further the church’s mission to meet needs while also providing financial benefits.

Check out our Church Fundraising Ideas for an in-depth guide on practical church fundraising ideas that will help your ministry fund all of its powerful initiatives.

#6 Church Money Strategy: Adhering to Tax and Legal Aspects

A critical aspect of the management of church money involves understanding and adhering to tax implications and legalities, ensuring both compliance and optimization of financial resources.

Churches in many regions enjoy tax-exempt status, which significantly impacts how church money is managed.

This status provides substantial financial benefits, allowing more funds to be directed towards ministry activities rather than tax obligations.

However, with these benefits come responsibilities and a need for strict adherence to regulations.

The primary benefit of tax exemption for churches is the significant reduction in financial burdens, allowing more of the church money to be used directly for its core purposes like community service, worship activities, and spreading religious teachings.

However, maintaining this status requires churches to comply with specific legal standards and regulations.

These regulations often dictate the kinds of activities a church can engage in and how church money can be utilized and reported.

The complexities of tax laws and the legalities surrounding church finances can be challenging to navigate.

It’s crucial for churches to seek professional advice on these matters.

Tax advisors and legal experts specializing in non-profit and church finances can provide invaluable guidance.

They can assist in ensuring compliance, thus protecting the church from legal complications that could jeopardize its financial stability and public reputation.

#7 Church Money Strategy: Balancing Spirituality and Stewardship

In the realm of church money management, there lies the profound challenge of balancing spiritual objectives with the practicalities of financial stewardship.

This balance is crucial for the church’s success and sustainability.

By diversifying income streams, churches can create a robust financial foundation that supports their mission.

Embracing effective financial management practices ensures that church money is used efficiently and responsibly.

Deep engagement with the community not only furthers the church’s spiritual mission but also bolsters its financial stability through fostering goodwill and support.

Churches must remain dynamic in their approach to finance, continuously adapting and innovating their strategies.

Staying true to their core mission of service and spirituality, while skillfully managing church money, is key to thriving in today’s complex financial landscape.

This careful balance of spirituality and stewardship is essential for churches to succeed in their dual role as spiritual guides and responsible financial entities.

That takes us to the end of our financial strategies for church money.

Let us know your thought’s in the comments below.

Church Money FAQs

Q: What is zero-based budgeting, and how does it benefit churches?

Zero-based budgeting is a financial strategy where every expense must be justified for each new period, starting from zero. This approach benefits churches by ensuring that every dollar spent aligns with the church’s mission and goals. It encourages prudent spending and strategic allocation of funds, leading to more efficient and impactful use of church money.

Q: How do churches manage investments and what types of investments are commonly pursued?

Many churches manage investments by diversifying their portfolio, including stocks, bonds, and real estate. These investments provide additional income streams and financial stability. Churches typically pursue low-risk investments and may consult with financial advisors to align their investment strategies with their long-term objectives and risk tolerance.

Q: Why are emergency funds important for churches?

Emergency funds are crucial for churches as they provide a financial safety net for unforeseen expenses and challenges. These reserves ensure that churches can continue their operations and ministries without disruption during unexpected financial crises, thus maintaining their commitment to serving their congregation and community.

Q: Can churches engage in entrepreneurial ventures, and what are some examples?

Yes, churches can engage in entrepreneurial ventures as part of diversifying their income. Examples include opening a bookstore, a coffee shop, or a childcare center within the church premises. These ventures not only generate additional income but also serve as platforms for community outreach and engagement.

Q: What are the legal and tax implications churches must consider in financial management?

Churches must navigate various legal and tax implications, including maintaining their tax-exempt status by complying with specific regulations. This includes ensuring that their activities and financial practices align with legal standards for non-profits. Churches often seek professional advice to manage these aspects effectively, ensuring compliance and optimal use of their financial resources.

Responses