A church recession is a tough time that can stretch your church’s money and operations thin. But it’s also a chance to grow and rethink your strategy. By learning about things like inflation and managing your cash and expenses wisely, your church can not only get through it but come out stronger.

If you are in ministry and want more information on how to get through church recession and other difficult financial times, this post is exactly where you need to be.

What Is A Recession?

If you ask most people what a recession is, they may not have a clear answer, or they might say that “it’s when the economy falls on hard times.”

In the field of macroeconomics, there is a more specific definition. A recession is defined by a decrease in Gross Domestic Product (GDP) for at least two consecutive quarters.

GDP is the total value of a country’s economy over a certain amount of time, in this case, quarters.

In other words, a recession is a contraction in the economy that leads to less business activity, buying, selling, and a general decrease in prosperity overall.

Recessions in the Bible

Recessions or economic downturns are not explicitly mentioned in the Bible, as the modern concept of a recession did not exist during biblical times. However, the Bible does speak about times of economic hardship and how people responded to them.

One example is the story of Joseph in Genesis 41-47. In this story, Joseph is sold into slavery by his brothers and eventually ends up in Egypt, where he interprets Pharaoh’s dream of seven years of plenty followed by seven years of famine. Joseph helps Pharaoh prepare for the famine by storing up grain during the years of plenty. When the famine hits, the stored grain becomes a vital resource for the people of Egypt and surrounding nations. Through Joseph’s foresight and planning, Egypt was able to survive the famine and even thrive during the downturn.

Another example is the story of Job in the Book of Job. Job was a wealthy man who suffered a series of tragedies, including the loss of his property, health, and family. Despite his losses, Job remained faithful to God and eventually regained his wealth and prosperity. This story highlights the importance of perseverance and trust in God during times of hardship.

In Luke 15:11-32, Jesus tells the parable of the prodigal son, who squandered his inheritance and ended up in a desperate situation during a famine. The prodigal son eventually repents and returns to his father, who welcomes him back with open arms. This parable illustrates the importance of repentance and forgiveness, even in times of economic hardship.

In summary, while the Bible does not explicitly mention recessions, it does provide guidance on how to respond to economic hardships, including the importance of foresight, perseverance, trust in God, repentance, and forgiveness.

The Downward Recession Spiral

Recessions often have a way of feeding on themselves, making the recession worse over time.

A recession may start when the Federal reserve rises too high and companies’ debt cost become unmanageable. The companies then are forced to lay off employees. The people who are now out of work are forced to spend less money, which in turn means more businesses have financial problems. This then leads to more layoffs.

If you’re reading this and you are experiencing church recession problems, it’s time to get things in order. There is a chance that the worst has yet to come, and it’s better to get your house in order now than to wait.

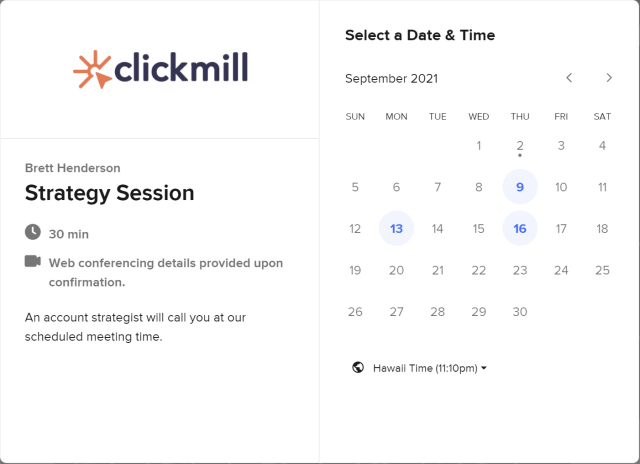

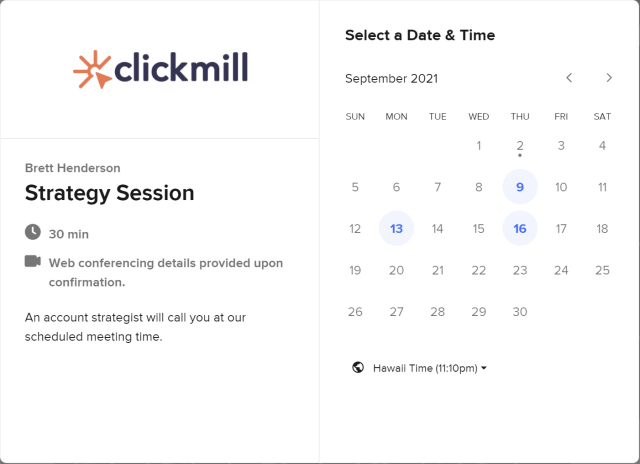

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

How Does A Recession Impact Your Church?

Recessions can have a significant impact on churches. This is because churches typically get their cash inflows through tithes and offerings, and when their congregants don’t have as much money to give, they don’t give as much. This reduces the overall cash inflows into many churches which in turn leaves many churches with the inability to make ends meet.

Why Recession Is A Huge Opportunity For Your Church

Recessions can be a scary thing for many church leaders, but recessions are something that skilled investors look forward to!

Being that you and I are investors in the kingdom of heaven, recessions are one of the best times to grow your ministry if you have yourself set up right!

How could this be true?

Let’s think financially for a moment, then we will think spiritually. In a recession, the general public panics. They begin selling their assets (stocks, bonds, real-estate) before those assets become worthless and they lose everything. This selling is why the markets drop in a recession.

The more fear there is in the market, the more people sell and the lower markets go. The general consensus is that this is a bad thing. But it’s only bad if you’re the one selling.

Successful investors never sell in panic. In fact, they look forward to the panic because it means prices will be steeply discounted. Investors know that it’s time to go shopping when everyone else is afraid. This approach to investing is called contrarianism, and the very best business leaders and investors buy in the downturns and sell when everyone else is buy and bidding up prices.

Investors love a good recession.

The same is true spiritually for your ministry. Consider this passage from Matthew:

“While Jesus was having dinner at Matthew’s house, many tax collectors and “sinners” came and ate with him and his disciples. When the Pharisees saw this, they asked his disciples, “Why does your teacher eat with tax collectors and `sinners’?” On hearing this, Jesus said, “It is not the healthy who need a doctor, but the sick.”

The religious leaders of the time did not perceive themselves to have need. Not only were they wealthy, affluent, powerful and educated, but they actually believed themselves to be righteous.

Jesus is saying that it is the sick person who knows he needs a doctor, and willingly seeks one out. Those who perceive themselves to be healthy don’t believe they need help, and therefore they don’t seek any out.

The same is true in many wealthy countries. The most difficult time to do ministry is when times are good. People are prosperous and they don’t feel that they are in any need. When people believe they don’t have any need, they also have no reason to seek out God for help.

Jesus knew that meeting people’s needs was the fastest way to their hearts. This is why Jesus put such a heavy emphasis on meeting nonspiritual needs.

Jesus met the fisherman’s need for fish, gave sight to the blind, fed the hungry crowds loaves and fish, healed the lame, cleansed the lepers, etc.

After Jesus met the needs of the people, the brought more people to him and followed him. We can see this in the passage below.

“Jesus went throughout Galilee, teaching in their synagogues, proclaiming the good news of the kingdom, and healing every disease and sickness among the people. 24 News about him spread all over Syria, and people brought to him all who were ill with various diseases, those suffering severe pain, the demon-possessed, those having seizures, and the paralyzed; and he healed them. 25 Large crowds from Galilee, the Decapolis, Jerusalem, Judea and the region across the Jordan followed him.”

In a recession, the people surrounding your church will be in greater need than they would otherwise be in. If they discover that your church is meeting needs during a recession, they will be much more likely to participate in your ministry.

Both stocks and souls go on sale in a recession.

In the following sections, we will be discussing how to position your ministry to have the greatest possible impact on your community during a recession.

If you love this post, you’ll also enjoy our article titled, Church Consulting: Hire Your Ideal Church Consultant.

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

Church Economics: What is Inflation?

Inflation is the expansion of the money supply, which is elastic in the United States. The Federal Reserve has the ability to create or reduce the overall money supply. The most common way the money supply increases is through the creation of new dollars, which are then injected into the economy, usually through low-interest rate loans given to banks from the Federal Reserve. When banks have more money, they give more loans, which means people and businesses have more money to spend. This increase in spending drives up prices.

It’s important to understand the distinction between price inflation and monetary inflation. Price inflation is not inflation itself; it’s a result of monetary inflation (the increase in the money supply). When the money supply increases, it makes all the money in the economy less valuable, since there’s more money chasing the same amount of goods and services. When there’s more money for the same amount of things, those things must cost more.

For example, in response to COVID, the Federal Reserve and the US government went on a spending spree fueled by new money. You can see in the image below that the money supply (M2 money) increased by 42% in 2020. It’s no surprise that we’ve been seeing soaring price inflation following 2020.

How Does Inflation Impact Your Church?

Inflation is a sneaky way for governments to tax their residents. Inflation allows them to devalue their countries own currency by printing new currency. This means when governments create new money units, they spend them when they are still valuable. Over time, the money trickles down from the government to banks and big businesses, then to the small businesses, and then to the citizens.

By the time the money reaches the citizen, the money has typically been devalued. This means the everyday citizens feel as though they are becoming wealthier even though they have received money that has less purchasing power than it did before. This also means that by printing money, the people in power are giving themselves first access to the new money when it still retains its original purchasing power, enriching them while impoverishing the everyday people.

When the money supply goes up, the purchasing power of each dollar goes down. This means that if your church has money sitting in the bank during a high inflationary time, your money is losing value.

Suppose for example that your church has 100,000 sitting in the bank for 12 months. Over those 12 months, inflation runs at 10%. While all 100,000 of the ministry cash is still in the bank, inflation has eaten away $10,000 worth of purchasing power. After one year of 10% inflation, your money is able to purchase 10% less stuff.

Church Economics: What is Deflation?

Deflation is the opposite of inflation. Deflation is what happens when the money supply shrinks. Deflation naturally leads to a stronger currency because there is less of the currency. When there is a lower supply of the currency, then there is more supply for it which drives up the value of the currency.

Price deflation is what happens to prices during monetary deflation. When the money supply shrinks, people can’t ask for as much money for things, so prices drop.

How Does Deflation Impact Your Church?

While every church’s situation is unique, deflation can result in the money held by your church increasing in value. This means that the purchasing power of each dollar in your bank account increases during deflation. In addition, the cost of products, services, and utilities will decrease during deflation, which could help your church save money on expenses.

However, it is important to note that deflation may also result in a decline in the value of church assets, such as property. This is because it would require fewer dollars to purchase property during deflation. Overall, the impact of deflation on your church’s finances can be influenced by many factors, and it’s important to carefully monitor and adjust your financial strategies accordingly.

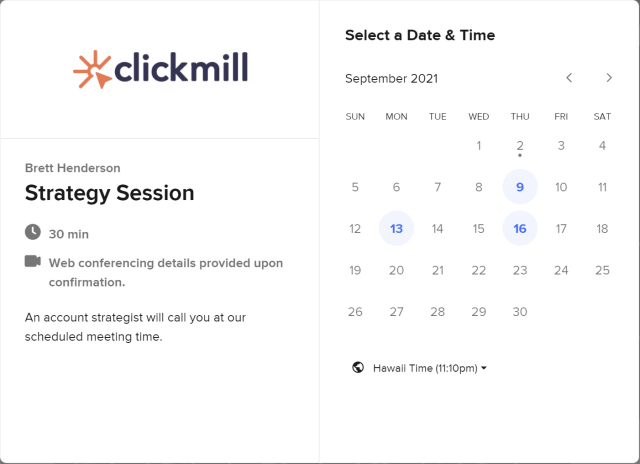

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

Church Economics: What Is Stagflation?

Stagflation is a term used in macroeconomics to describe a situation where the economy is experiencing both stagnant growth and high inflation at the same time. This can be a particularly challenging economic environment because the traditional methods used to combat inflation can actually worsen the stagnation, and vice versa.

To put it simply, stagflation is a scenario where the prices of goods and services are rising, but the overall economy is not growing. This means that businesses are not able to increase their output, which leads to a rise in unemployment rates. At the same time, people are finding that the prices of the things they need are going up, which means they can buy less with the same amount of money.

One of the major causes of stagflation is a decrease in the supply of key resources such as oil or other commodities, which can lead to a rise in prices. However, other factors such as government policies, high taxes, and inflationary monetary policies can also contribute to stagflation.

For pastors, stagflation can be particularly challenging because it can result in lower giving and a decreased ability for churches to carry out their missions. It is important for church leaders to be aware of the potential impact of stagflation on their congregations and to have a plan in place to address it. This may include adjusting budgets, finding ways to reduce costs, and encouraging members to give generously despite the economic challenges.

How Does Stagflation Impact Your Church?

Stagflation can have a significant impact on churches and their congregations. The combination of high inflation and stagnant growth can lead to reduced purchasing power, lower giving, and decreased financial stability.

During periods of stagflation, prices of goods and services tend to rise, which can lead to higher costs for churches as they try to maintain their operations and ministries. This can put pressure on church budgets and force them to make difficult choices about where to allocate resources. In addition, the stagnant economy can lead to higher unemployment rates and reduced job security, which can impact the giving ability of church members and reduce their ability to support the church financially.

Furthermore, the psychological impact of stagflation can be significant. People may feel anxious about their financial situations and may be less inclined to give generously to their church. The uncertainty and unpredictability of a stagflationary environment can also make it challenging for church leaders to plan for the future and make strategic decisions.

Church Economics: What Is A Bubble?

In economics, a bubble refers to a situation where the price of an asset (such as a stock, real estate, or cryptocurrency) becomes significantly overvalued relative to its intrinsic value. Bubbles often occur when there is a lot of speculation and hype around an asset, leading to a frenzy of buying and driving up its price beyond its actual worth.

Bubbles can be difficult to identify because they can go on for an extended period of time, with prices continuing to rise even as the asset becomes increasingly overvalued. However, bubbles are typically unsustainable and will eventually burst, leading to a sharp decline in the price of the asset.

When a bubble bursts, it can have a significant impact on the economy as a whole. For example, the bursting of the housing bubble in 2008 was a major contributor to the global financial crisis that followed. Bubbles can also have a significant impact on individual investors who may have invested heavily in the asset in question, only to see their investments lose value rapidly.

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

How Do Bubbles Impact Churches?

Bubbles can impact churches in a number of ways. Often, when debt is cheap (low interest rates) and easy to get, churches take on too much debt and overspend. This is common to organizations in every industry. When monetary policy is loose, we feel that we can afford more than we otherwise would. The Federal Reserve knows this and it is the exact reason they drop interest rates.

Low interest rates to borrow money incentivizes us to take on more debt. Organizations and people then spend more money into the economy, pushing it up. Many church will discover that overly optimistic emotions during a bubble have lead to bloated church spending, hiring, and even taking on more debt than they should have.

When a bubble pops, churches may begin to realize their assets were overvalued. For example, if there was a bubble in real-estate, the valuation of the church property may have been significantly overpriced. When the bubble pops, the net worth of the church also drops because the land then devalues. This is further exacerbated if the church used it’s assets as collateral for loans during the boom.

If you used a property valued at 5 million as collateral to purchase another 5 million dollar facility, but the property used as collateral drops to a 3 million dollar valuation when the bubble pops, then the church is technically insolvent. If they cannot keep up with the loan payments, they do not have enough value in assets to cover the cost of the debt.

Furthermore, when a bubble bursts, it may negatively impact the cash flow of the church. If you congregation has their retirement in the stock market, and the market bubble pops, fear will ensue in your congregation and they will likely tithe less because their own net worth has taken a dive.

Church Economics: What Causes A Recession?

Recessions can be caused by any number of events, some of which are more predictable than others.

Supply Shocks: Unforeseen supply shocks to the economy, such as a natural disaster or geopolitical crisis, can cause recessions. For example, the oil embargo crisis of the 1970s led to a quadrupling of oil prices due to reduced supply, leading to reduced spending in other areas and a ripple effect throughout the economic landscape.

Interest Rate Hikes: Recessions can also be caused by more predictable events, such as the Federal Reserve hiking interest rates in response to high inflation. This makes debt more expensive, leading businesses to lay off employees, causing a cycle of austerity measures, which puts further pressure on businesses (and churches) and can lead to more layoffs.

Black Swan Events: These are dramatic and unforeseeable catastrophic events that nobody can predict. For example, the assassination of Archduke Franz Ferdinand inevitably led to World War I, pulling the allies of both countries into conflict.

Fear: It can also be said that fear causes recessions. When people are afraid, they begin to slow their spending, hurting businesses and leading to layoffs. People may also withdraw money from banks for safekeeping, which, if too many people do so at once, can cause a bank run and the breakdown of the banking system, which can itself cause a recession.

Understanding the potential causes and effects of a recession is essential for any church leader who wants to navigate these challenging times successfully. By keeping a watchful eye on economic indicators and adopting the right strategic positioning, churches can weather the storms of a recession and emerge stronger and more resilient than ever before. With this understanding in mind, let’s explore some of the strategic positioning options that can help your church thrive in a recessionary environment.

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

Strategic Positioning For Churches In Recession

Recessions can present unique challenges for churches and ministries, impacting their ability to carry out their mission and vision. By taking a strategic and proactive approach to their finances and operations, churches can weather economic downturns and emerge stronger on the other side.

In this section, we will explore some key strategies and principles for strategic positioning in a recessionary economy. We will discuss the importance of pruning and streamlining expenses, optimizing cash allocation, and gathering and analyzing financial data. We will also explore some of the unique challenges and opportunities presented by different economic scenarios, such as inflation, deflation, stagflation, and bubbles. By implementing these strategies and staying committed to their mission and vision, churches can navigate the challenges of a recession and continue to serve their communities with excellence and purpose.

**ATTENTION: THIS IS NOT FINANCIAL ADVICE, PLEASE CONSULT YOUR FINANCIAL ADVISOR BEFORE IMPLEMENTING ANYTHING YOU READ IN THIS ARTICLE OR ONLINE

Recessions Are A Season Of Church Pruning

In times of plenty, people naturally take on expenses that are wasteful and unnecessary.

For example, many American families have monthly subscriptions they aren’t even aware of that are billed to their accounts every month. This remains to be the case until it seems like there may not be enough money to go around, and then they begin hunting down all of the unnecessary expenses.

If your church is experiencing a recession and you are reading this article, it’s more than likely time to cut out all unnecessary expenses.

You cannot continue the same spending you used prior to the recession, in the recession. A recession generally works like a bad flu. When you get the flu, your body heats itself up until the high temperature kills all of the toxic virus living inside you.

This is also true for recessions. The reason a recession happens is because there is too much toxic debt and toxic assets in an economy for it to function normally. The toxicity triggers an economic reaction that works to rid the economy of what ails it. Only after the toxic debt and assets are removed can the economy become healthy again.

This means the economy as a whole will try to either get rid of your debt or get rid of your church all together. If your church has unnecessary expenses or too much debt on the books, you essentially have two choices. You can:

- Get things in order as quickly as possible

- Go out of business

For many churches, doing nothing will not be an option. Recessions are a season when churches need to be pruning, and pruning is painful.

In the coming sections, we will be going through some of the ways you can most effectively prune your ministry to thrive in and after a recession.

Church Recession Survival Strategy 1: Two Rules Of Cash Allocation

When considering what to prune out of your ministry, it’s important that we continue to be good stewards of the finances and programs that God has blessed us to oversee.

You don’t want to cut more programs that are necessary, but you also want to cut enough that your ministry has enough financial breathing room each month to get through the recession.

There are two basic financial rules of investing ministry finances that we should observe. These two rules will help us discern when to keep pruning, and when to stop.

- Don’t lose money

- Make money

Be aware, I am speaking financially here and am not trying to say that the purpose of ministry is to make money. If your ministry is looking at hard times and you have no choice but to prune, you need to keep what is financially effective and lose what is financially ineffective.

The programs that cost a lot of money but produce little fruit are the ministries the should most likely be the first to go.

In the coming section, your first goal is to stop the bleeding, your second goal is to create extra cash flow to give your ministry the room it needs to cope with future financial shocks. Ideally, we will be able to do this in a way that has a small downside while having a dispoportionate positive upside.

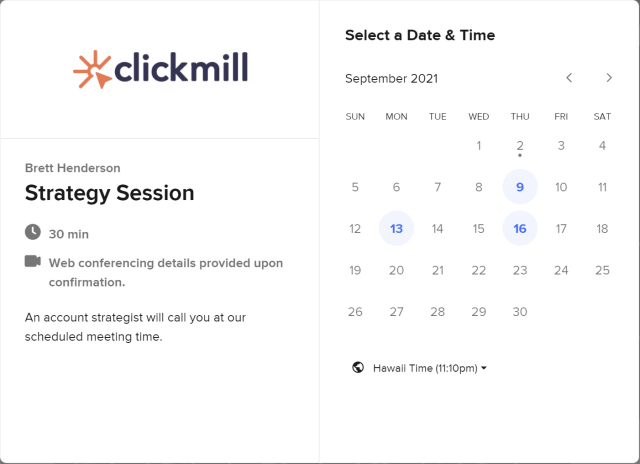

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

Church Recession Survival Strategy 1: Gather Your Financial Data

As a pastor, you know how important it is to have a clear understanding of your church’s financial situation. To make informed decisions about strategic positioning during a recessionary economy, you need to gather and analyze financial data. This data can provide valuable insights into areas of strength and weakness, and help guide your decision-making.

Let’s take a closer look at some key areas of financial data to gather:

Cash Inflows

Number of donors: How many individuals or organizations are contributing financially to your church? This helps you understand the size and scope of your donor base.

Total Giving: What is the total amount of financial support coming into your church, including tithes, offerings, and other forms of giving? This gives you a sense of your overall financial health.

Additional income streams: Are there any other sources of income for your church, such as grants, rental income, or fundraising events? This helps you identify additional revenue streams that can support your church’s financial stability.

Cash Outflows

Staffing Costs: What is the total cost of compensating your staff, including salaries, benefits, and payroll taxes?

Programs Costs: What is the cost of running programs and ministries, such as youth groups, worship services, and outreach initiatives?

Debt Costs: Do you have any outstanding debts or loans that require regular payments? If so, what is the total cost of servicing those debts?

Event Costs: What is the cost of hosting events or other special activities, such as conferences, retreats, or concerts?

By gathering this financial data, you can get a better sense of where your church’s money is coming from and where it’s going. This information can then be used to make strategic decisions about budgeting, fundraising, and cost-cutting measures that can help your church weather the challenges of a recessionary economy.

Church Recession Survival Strategy 1: Streamline Your Expenses

Once you have gathered your financial data, it’s time to start streamlining your expenses. This means identifying areas where you can cut costs without sacrificing the quality of your church’s programs and services. Here are some steps you can take to streamline your expenses:

Identify areas of excess spending: Look for areas where you may be spending more money than necessary, such as on office supplies, utilities, or equipment. See if there are ways to reduce these costs without affecting the quality of your church’s services.

Prioritize spending: Make a list of your church’s expenses and prioritize them in order of importance. This will help you identify areas where you can cut back if necessary, while still maintaining the core functions of your church.

Negotiate contracts: Talk to your vendors and service providers and see if there are ways to negotiate better rates or payment terms. You may be able to find cost savings by switching to a different provider or renegotiating your existing contracts.

Consider outsourcing: Look for areas where you may be able to outsource certain functions, such as bookkeeping or IT support. This can help reduce staffing costs and free up resources for other areas of your church’s operations.

Leverage technology: Look for ways to leverage technology to reduce costs and improve efficiency. For example, using online giving platforms can help reduce administrative costs associated with collecting and processing donations.

Use the 80/20 rule: This principle, also known as the Pareto Principle, suggests that 80% of the results come from 20% of the efforts. In other words, 20% of the programs or ministries in a church are responsible for 80% of the fruit or desired outcomes.

To implement the 80/20 rule, you should first determine the desired results for each ministry or program in your church. Then, conduct an 80/20 audit by identifying which ministries or programs are producing the most fruit and which are not. The goal is to focus on the 20% of ministries or programs that produce 80% of the fruit while cutting back on the remaining 80% that produces only 20% of the fruit.

By using the 80/20 rule, you can identify which programs or ministries are the most effective and efficient, and allocate resources accordingly. This can help your church make the most of its resources while still achieving its desired outcomes. Additionally, this can be a helpful tool in determining which ministries or programs may need to be scaled back or even eliminated during times of financial difficulty.

By implementing an 80/20 audit of each ministry or program, you are not only identifying areas to cut back on during difficult times, but you are also able to identify where you should be investing more resources during times of plenty. By focusing on the 20% of ministries or programs that are producing 80% of the results or fruit, you can ensure that you are investing in the areas that will have the greatest impact on your congregation and community.

As you focus on investing in the most productive areas of your ministry, you will see exponential growth over time. By allocating more resources towards the programs and services that are producing the greatest results, you will see increased engagement from your congregation and the wider community. This, in turn, will lead to greater impact in your community and more people coming to your church.

In addition, by identifying areas to cut back on during times of plenty, you are freeing up resources that can be put towards investing in other areas of your ministry. This can lead to new programs or services being created that will produce even greater results, leading to even more growth in your ministry.

Therefore, the 80/20 rule is a valuable tool for not only managing your church’s finances during difficult times, but also for achieving exponential growth by investing in the areas that produce the most fruit.

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

Church Recession Survival Strategy 1: Free Up Monthly Cash Flow

It’s common for many churches to add new programs and services at the same rate at which their audience and tithes grow. While this may seem like a good idea in times of plenty, it can actually make the church brittle and unprepared for any unforeseen downturns in the economy.

When churches scale their expenses in line with their income, they often leave themselves with little margin for error or unforeseen events. If a recession hits or there is an unexpected drop in donations, the church can quickly find itself struggling to make ends meet.

Instead of scaling expenses with income, I recommend operating and scaling below your monthly income and always having extra cash flow on hand for scarce times. This will create a cushion for the church in case of any sudden or unexpected drops in income.

By operating below your monthly income, you’re effectively creating a buffer that can help your church weather any storms that come your way. This approach may seem conservative, but it is a far more sustainable approach to managing your finances in the long term.

Plus, by operating in this way, you can free up additional resources that can be put back into the ministries that are producing the most fruit, which can lead to exponential growth in the ministry.

Church Recession Positioning & Bubbles

Bubbles are a common occurrence in the economy. A bubble is a situation where prices of certain assets (such as stocks, real estate, or cryptocurrencies) rise rapidly to unsustainable levels, far above their intrinsic value. At some point, the bubble inevitably bursts, and prices plummet, often leading to a recession or even a depression.

During a bubble, the prices of certain assets can rise so high that it becomes very difficult for investors to avoid participating in it, even if they know it’s unsustainable. The fear of missing out (FOMO) can lead many to invest in these assets, creating an even bigger bubble.

In times like this, sophisticated investors position themselves to avoid the impact of the bubble when it pops. They often do this by diversifying their portfolios and investing in different assets that aren’t affected by the same bubble.

The same can be applied to churches. Churches can avoid the impact of a bubble by diversifying their sources of income and investments. Don’t put all your eggs in one basket, so to speak. If your church relies solely on donations and tithes, a recession could have a catastrophic impact.

As a church leader, you can position your church to withstand the impact of a bubble by:

Diversifying your church’s sources of income: Encourage your congregation to consider non-traditional forms of giving, such as donating stocks or property. Seek out grant opportunities or partnerships with local businesses or non-profit organizations.

Diversifying your church’s investments: Avoid investing all of your church’s money in one type of asset or market. Consider investing in a mix of stocks, bonds, and real estate, so that if one market crashes, you are protected by the others.

Scaling below your monthly income: As we discussed earlier, scaling up your expenses as your income grows makes your church brittle to any unforeseen downturns in the economy. Instead, operate and scale below your monthly income and have extra cashflow for scarce times.

By diversifying your church’s sources of income and investments, and by scaling below your monthly income, you can position your church to withstand the impact of a bubble and emerge from a recession stronger than before.

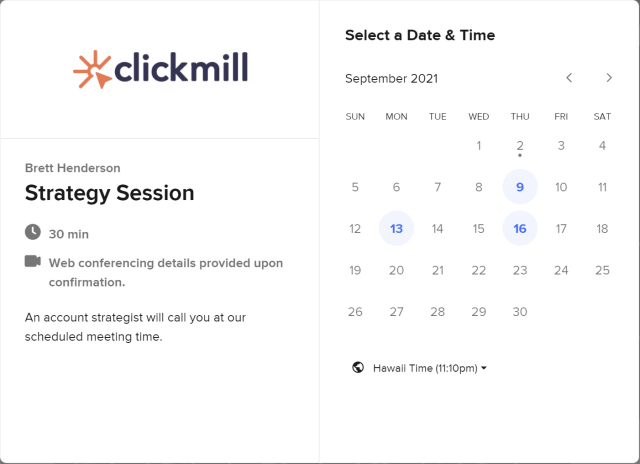

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

Church Recession Positioning & Contrarianism

In a down economy or during a bubble burst, following the crowd can often lead to the same negative results as everyone else. Smart investors and business leaders follow the opposite of the crowd, a strategy known as contrarianism.

Contrarian investors buy when others are selling and sell when others are buying. This approach allows investors to take advantage of market inefficiencies and buy assets at a discount before the market rebounds.

The same is true for churches. If a church is well-positioned during an economic downturn, it can be a unique opportunity to purchase church assets on a firesale. For example, during the Great Recession, some churches were able to purchase commercial properties at a significant discount, which allowed them to expand their ministries and reach more people.

To position your church for success during a downturn, consider taking a contrarian approach to your financial decisions. Instead of following the crowd and expanding programs and services during times of plenty, consider scaling back and focusing on the core ministries that are producing the most fruit.

By doing this, you can free up resources that can be put back into the core ministries to create exponential growth. You should also consider building up cash reserves during times of plenty so that your church has a buffer to weather the storms of a down economy.

In summary, the contrarian approach can be an effective strategy for churches to position themselves for success during a recession. By taking a step back and focusing on core ministries, building cash reserves, and being ready to take advantage of firesale opportunities, your church can thrive even in challenging economic times.

Church Recession Positioning For Inflation

When it comes to church recession positioning for inflation, it’s important to consider investment strategies that can hedge against the impact of inflation. One such strategy is to invest in commodities, which are physical goods that are traded on markets. Commodities, such as precious metals (gold, silver), agricultural products, and energy resources, have traditionally held their value during times of inflation, making them an attractive option for investors looking to hedge against inflation.

Another investment strategy to consider is real estate. Real estate investments, such as rental properties, can be an effective way to hedge against inflation because real estate tends to appreciate in value over time, often keeping pace with or exceeding the rate of inflation. Additionally, rental income from real estate investments can provide a reliable stream of passive income, which can be especially valuable during times of inflation.

There are also other inflation-protected securities that investors can consider, such as Treasury Inflation-Protected Securities (TIPS), which are U.S. government bonds that are indexed to inflation. TIPS pay a fixed interest rate, but the principal value adjusts with inflation, which helps to protect against the impact of inflation.

It’s important to note that while these investment strategies can help to hedge against the impact of inflation, they are not foolproof. Commodities, real estate, and other inflation-protected securities can still experience volatility and other risks, and it’s important to carefully consider these risks before making any investment decisions.

During times of inflation it’s also important to consider these two following suggestions.

Adjust Prices: If your church offers any products or services in an inflationary environment, prices will be increasing across the board. Your church may need to adjust prices for services or products to keep up with rising expenses. This can be a delicate balance, as you don’t want to price out members of your congregation who may be struggling financially.

Be Prepared for Interest Rate Changes: During times of inflation, central banks may raise interest rates to combat rising prices. This can impact the cost of any loans your church may have, such as mortgages or lines of credit. It’s important to be prepared for potential interest rate changes and to have a plan in place to handle any increased costs. If you plan on getting a loan for a church building or any other property, consider a fixed interest rate (which cannot change if banks raise interest rates).

Having a fixed interest rate on your church mortgage can provide stability and certainty in uncertain times. This is especially important during a recession or inflationary environment when interest rates can fluctuate rapidly. A fixed-interest rate mortgage ensures that your monthly mortgage payment remains the same throughout the life of the loan.

If your church currently has a variable-rate mortgage, it may be a good idea to consider refinancing to a fixed rate mortgage. This can be done by finding a lender that offers fixed interest rate mortgages and applying for a new loan. It’s important to note that refinancing a mortgage can come with fees and closing costs, so it’s important to weigh the costs and benefits before making a decision.

When considering a fixed interest rate mortgage, it’s also important to shop around and compare rates from different lenders. This can help ensure that you’re getting the best possible rate for your church’s financial situation.

As a church leader, it’s important to work with a trusted financial advisor who can help guide you in developing an investment strategy that aligns with your church’s financial goals and risk tolerance. By being proactive and strategic in your investment approach, you can position your church to weather the impact of inflation and emerge stronger on the other side.

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

Church Recession Positioning For Deflation

In a deflationary environment, it’s important for churches to be prepared for the potential drop in revenue and to have a plan in place for reducing expenses. Here are some strategies for positioning your church during deflation:

Build Cash Reserves: During a deflationary period, cash becomes more valuable over time as prices decrease. Therefore, it’s essential to build cash reserves to weather the potential storm.

Minimize Debt: High levels of debt can be particularly dangerous during deflation, as the value of money increases over time, making it harder to pay back debts. Reducing debt as much as possible will put your church in a more stable financial position.

Diversify Investments: In deflation, stocks and real estate tend to decrease in value. Therefore, diversifying investments into other assets such as commodities and inflation-protected securities can help protect the church’s portfolio from deflationary pressures.

Consider Fixed Income Investments: Fixed-income investments such as bonds can provide a stable income stream during deflationary periods. The income generated from bonds can be reinvested into the church’s operations or used to build up cash reserves.

Cut Costs: During a deflationary period, churches should be prepared to cut costs wherever possible. Streamlining programs, reducing staffing, and cutting non-essential expenses can help reduce overall costs and improve financial stability.

In terms of mortgages, churches may benefit from refinancing to a lower fixed interest rate during deflationary periods. This can reduce interest payments and help improve cash flow, which can be used to build up reserves or invest in church programs. It’s important to work with a trusted financial advisor to determine the best course of action for your church’s unique financial situation.

Church Recession Positioning For Stagflation

Stagflation is a tricky situation where prices are rising while the economy is stagnant or shrinking. This can be a tough environment for churches to navigate. Here are some positioning strategies to help churches during stagflation:

Diversify Your Investments: During stagflation, traditional investments like stocks and bonds may not perform as well. It is important to diversify your investments into other areas like commodities, real estate, and precious metals. These investments can help hedge against inflation and provide a stable foundation for your church’s finances.

Cut Costs: During stagflation, costs may rise while income stagnates. It is important to cut costs where possible to maintain financial stability. This may mean reducing staff or programs, renegotiating contracts, or finding more cost-effective ways to operate.

Generate Additional Income: Stagflation may require churches to think outside the box when it comes to generating income. Consider ways to diversify income streams, such as renting out unused space, offering classes or workshops, or partnering with other organizations for fundraising events.

Consider Inflation-Protected Securities: Inflation-protected securities, like Treasury Inflation-Protected Securities (TIPS), are investments that are designed to keep pace with inflation. These securities can provide a hedge against inflation and provide stability during stagflation.

Evaluate Debt: During stagflation, it may be wise to evaluate your church’s debt situation. Consider refinancing debt to a fixed interest rate or paying off high-interest debt to reduce interest payments.

By implementing these strategies, churches can position themselves to weather the challenges of stagflation and maintain financial stability.

Get A Proven Marketing Plan That Increases Enrollments When You Book A Call Today!

Receive customized advice to help your school attract more families!

Church Growth In Recession: Creating A Safety Net For Your Congregation

During a recession, many people are facing financial uncertainty and may be looking for a source of hope and stability. As a church leader, this is an opportunity to create a safety net for your congregation and help them navigate through tough times.

One of the most important things you can do is to maintain a strong vision for your church. This vision should be communicated to your congregation with transparency and consistency. Be open and honest about the challenges you face as a church, but also provide a clear direction and plan for moving forward.

It’s also important to focus on meeting the needs of your congregation during a recession. This may include providing financial counseling or assistance, hosting job fairs, or offering support groups for those struggling with anxiety or depression. By being a source of practical help and emotional support, you can build trust and loyalty within your congregation.

In addition, a recession can be a prime time to buy assets on a firesale. If your church is in a strong financial position, consider purchasing property or equipment at a discounted rate. This can help position your church for growth once the economy improves.

Above all, it’s important to maintain hope and optimism during tough times. This is a chance to come together as a community and support one another. By demonstrating faith in the future and providing practical support, your church can not only survive but thrive during a recession.

FAQs

A recession is a period of economic decline, typically identified by a decrease in Gross Domestic Product (GDP) for two consecutive quarters. For churches, a recession can lead to reduced tithes and offerings as congregants may have less disposable income, impacting the church’s financial stability.

Churches can prepare for a recession by diversifying income streams, cutting unnecessary expenses, and focusing on core ministries. Building a reserve fund and encouraging digital giving can also help. During a recession, churches should prioritize community support and outreach, as needs within the congregation and community may increase.

Biblical stories like Joseph’s preparation for famine in Egypt and Job’s perseverance through personal losses teach the importance of foresight, planning, and maintaining faith in God during economic hardships.

Yes, a recession can be an opportunity for churches to grow their ministry. Economic hardships often lead people to seek spiritual support and community, allowing churches to reach out and meet both spiritual and physical needs, thus potentially increasing engagement and attendance.

During a recession, churches should avoid overextending financially, such as taking on excessive debt or launching costly new initiatives without secure funding. It’s also important to avoid cutting essential ministries that directly support the congregation and community.

That about sums it up for this post on church recession.

As we wrap up this article on church recession positioning, I want to ask for your help. We’ve covered a lot of ground and discussed a range of strategies to help your church weather economic downturns. Now, I want to hear from you.

What ideas do you have for implementing the strategies we’ve discussed? How can we work together to create a practical list of suggestions that all of us can implement in our churches to position ourselves for success during tough times?

Please share your thoughts and ideas about how to survive church recession in the comments below. Let’s help our churches thrive, even in the midst of a recession.

Responses